There’s no doubt that remote work is here to stay: 91% of people who are working at least some of their hours remotely hope their ability to work at home continues. And, a recent report from Ladders predicts that 25% of all high-paying professional jobs will be remote by the end of this year.

A lack of commute time, the flexibility to balance work and personal obligations, and improved well-being are some of the top-cited reasons driving this change. But it’s not just where and how people work that is changing; there are also lasting impacts on where people move and how they go about buying and selling a home.

When people aren’t tethered to an office, location isn’t an issue, and they’re free to buy homes wherever they want. In fact, about 32% of buyers in an Opendoor survey said that the pandemic influenced where they’ll choose to live, from big cities to the suburbs. And, with more people working from home, there’s been a shift in the home features that are most desirable as well. The Home Design Trends Survey from the American Institute of Architects found that more people are looking for multiple spaces in their home for remote work and virtual meetings. Suddenly, bonus rooms and flex spaces are at the top of buyers’ lists, even more so than gourmet kitchens or updated bathrooms.

Agents can help their clients not only navigate these changes, but get a leg up in the process. Here are three ways to help home sellers adapt to this new way of working and living.

Provide your sellers with options.

The traditional way of selling a home doesn’t always suit a homeowner’s unique needs. For example, they might be working from home with kids and pets underfoot, and the last thing they want to manage is keeping their house looking spick-and-span—not to mention, having to constantly leave the home for showings with prospective buyers. With the traditional real estate model, home sellers may host dozens of people in and out of their home, and oftentimes that can bleed into the work week, disrupting their meetings and daily routine. If the seller hires a cleaner, the average cost for a 2,000 square foot home is $150-$250—let’s say they’re having it cleaned 2-3 times per week for showings, that adds up quickly!

Another common scenario is that the seller needs a flexible move-out date after the home closes, to give them more time to move into their next home. Sellers are realizing that there are more options available to help them reach their end goal, such as iBuyers. In fact, research has shown that 71% of sellers are likely to consider selling their home to an iBuyer. Agents can partner with companies like Opendoor to present their clients with choices and help guide them to the best decision to meet their unique needs. Anything a listing agent can do to bring sellers more offers benefits everyone involved.

Leverage digital-first tools and services

The pandemic has accelerated the shift from offline to online solutions and has shown home sellers a world of new choices when it comes time to selling and buying a home. A full 75% of home buyers report that they would be likely to consider buying a home through a company that empowers them to control more of the process with digital tools.

Although working from home is often touted for its flexibility, there’s nothing more flexible than touring a home from the comfort of the couch. Virtual live, video and 3D tour options help buyers quickly check out homes that are listed, and decide which homes they want to tour in person. These tools put less pressure on sellers, too, by weeding out browser buyers from high-intent buyers. Additionally, there is a growing list of tools to digitize more aspects of the transaction, from mortgage tools to e-closing services, that agents can reach for when advising clients.

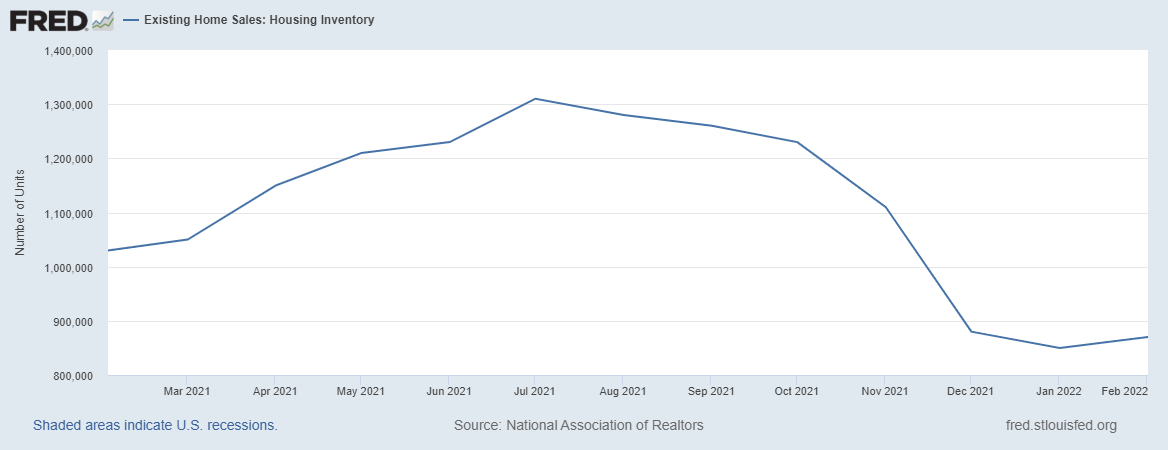

Be prepared for quick transactions since the market is so hot

With record-low inventory and high demand among buyers, homes are flying off the market at a record pace. And for the two-thirds of buyers who are also selling their home, the process can be slow, stressful and uncertain. Contingent deals can be a headache for everyone involved—they add time and costs that both sides of a transaction may not be able to afford. Agents can help buyers remove contingencies by working with a company like Opendoor that will make a cash offer on their current home, so the buyer can then shop for their next home with more certainty and confidence. Many times, the speed, convenience, and certainty these solutions provide may better suit a client’s specific needs.

Just like employers have found that there’s no longer a one-size fits all approach to where and how people work, agents and clients are finding that there’s no longer a one-size-fits all model of buying and selling a home. As the way we work, live and play continues to evolve, agents can help their clients explore more options for moving onto their next chapter.

Subscribe to RIS Media